Startups

How will AI and DePIN technologies change how startups are built and scaled?

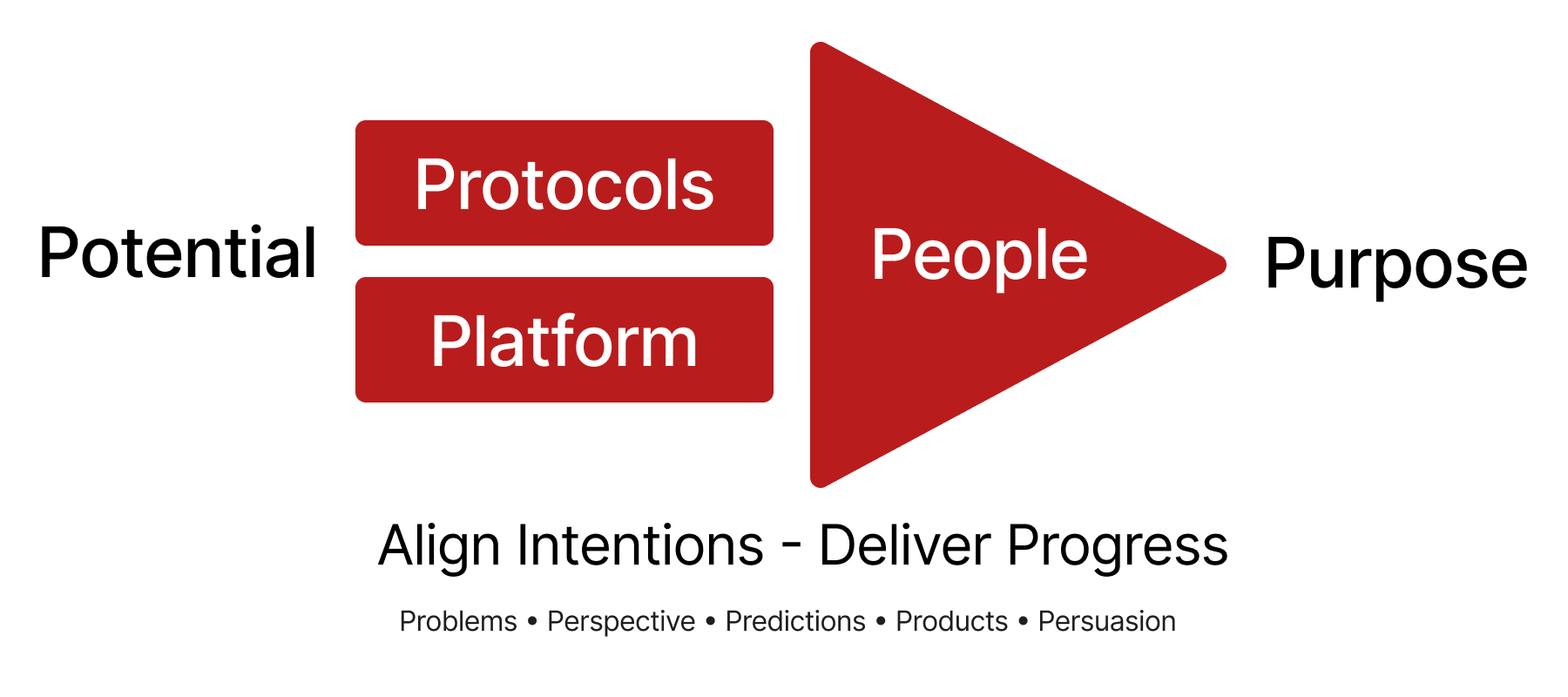

Progress

Use first principles to build trust while delivering value.

- Purpose: Know why you are here.

- Perspective: Interpret reality through alternative eyes.

- Problems: Have the courage to face the truth.

- Predictions: Anticipate trends and opportunities.

- Potential: Reimagine the future.

- Platform: Assemble assets and tools to gain leverage.

- People: Develop capabilities and deepen connections to build teamwork.

- Protocols: Evolve standards to optimize return from platform and people.

- Product: Distribute solutions that create value.

- Performance: Manage expectations while staying on course.

- Persuasion: Influence others to join your journey.

- Projects: Size your bets and manage risks.

- Question: Evolve your collective intelligence.

If you can't picture success or define value how will you know you are on the right path?

Community

Convert customers into a community of advocates and collaborators through alignment of incentive mechanisms.

- Who are they?

- What do they desire?

- What is their problem?

- How many of them are there?

- Do you feel their pain?

- How can you incentivise an extended salesforce?

Teammates

A startup must operate like a well-performing team.

There are core capabilities that everyone must have, the ability to sell the companies vision and products, the ability to communicate succinctly where there are gaps that are causing losses, and opportunities for potential gain. At the same time each person must own the specialisations of their role, and coordinate with other specialisations with maximum effectiveness. In great teams, you don't have to think about anyone else doing their job properly, you just focus on nailing your role to the best of your ability, if you fuck something up, you own it in front of the team, then look for feedback on how to improve.

Attitude

Back your mates, but embrace the danger, better to be a pirate than hide in the navy.

- Stay deeply involved in operations, not just high-level strategy

- Conduct regular skip-level meetings with employees at all levels

- Maintain hands-on approach in product development and key decisions

- Break traditional hierarchies when necessary for efficiency

- Trust your instincts and vision over conventional management advice

- Adapt leadership style as the company grows, but remain engaged

- Prioritize direct customer feedback and user experience

- Foster a startup-like culture, even as the company scales

- Be willing to challenge and replace underperforming executives

- Continuously innovate and drive the company's original mission

Front up or fuck off

Product

Vision and mission to provide purpose and bridge tech potential and business to serve customer needs.

Revenue Growth

Customer and community engagement.

Engineering

Business Admin

Delegate only when you must, then delegate business operations in this order:

Never delegate product management

Finances

Consider each point on the following checklist to make a more informed decision about whether venture capital funding aligns with your goals and business model. VC funding can provide significant resources and opportunities for rapid growth, it's not the right path for every business or entrepreneur.

Business Model Alignment

- Scalability: Does your business have the potential for rapid, exponential growth?

- Market size: Is your target market large enough to support venture-scale returns?

- Exit potential: Are there clear paths to a lucrative exit (acquisition or IPO) within 5-10 years?

Founder Goals and Readiness

- Growth ambitions: Are you aiming for rapid expansion rather than steady, organic growth?

- Equity dilution: Are you comfortable giving up a significant portion of ownership?

- External pressure: Can you handle the increased scrutiny and expectations from investors?

Financial Considerations

- Capital needs: Does your business require substantial upfront investment that can't be funded through other means?

- Revenue model: Is your business model designed to prioritize growth over immediate profitability?

- Return potential: Can your business realistically provide the high returns VCs expect (typically 10x or more)?

Operational Factors

- Team strength: Do you have a stellar team that can impress VCs and execute on ambitious plans?

- Proof of concept: Have you demonstrated initial traction or validated your business idea?

- Competitive advantage: Do you have a unique selling proposition or defensible intellectual property?

Strategic Alignment

- VC value-add: Would you benefit from the networks, expertise, and resources that VCs can provide?

- Long-term vision: Does your long-term vision for the company align with the typical VC investment timeline?

- Control: Are you willing to potentially cede some control and decision-making power to investors?

Alternative Funding Options

- Have you explored other funding options like bootstrapping, angel investors, or revenue-based financing?

- Would these alternatives better suit your business model and personal goals?

Pitching Investors

Build a complimentary suite of assets that explain the vision and mission.

See VC Investors

Do your research

Thoroughly research the VC firm and individual partners before meeting.

- Understand their investment thesis

- Research portfolio companies, and areas of interest

- What conditions of capital?

Target the Audience

- Focus on engaging directly with partners and managing partners, as they have the most influence over investment decisions.

- Avoid spending too much time pitching to associates or principals, who have limited decision-making power.

Prepare a compelling pitch

- Explain your opportunity clearly in the first 5 minutes.

- Have a strong, well-designed pitch deck but avoid reading directly from it.

- Be prepared to discuss your business model, market opportunity, competitive landscape, financials, and team in detail.

Know your numbers

- Be ready to discuss key metrics, revenue, burn rate, and financial projections.

- Have a clear ask in terms of funding amount and use of funds.

Demonstrate expertise

- Show deep knowledge of your market, customers, and competition.

- Be prepared to answer tough questions about all aspects of your business.

Highlight your team

- Emphasize the strengths and relevant experience of your founding team.

- Showcase your ability to recruit and retain top talent.

Be confident yet coachable

- Project confidence in your vision and ability to execute.

- Be open to feedback and willing to admit what you don't know.

Make it interactive

- Encourage questions throughout your pitch.

- Use the meeting as a chance to evaluate the VC as well.

Practice extensively

- Rehearse your pitch multiple times, ideally with experienced mentors.

Follow up effectively

- Send a thank you note after the meeting.

- Provide any additional information promised during the pitch.

Build relationships

- Approach fundraising as a long-term relationship-building process.

- Stay in touch with VCs even if they don't invest immediately.

Qualifying Investors

- What value can you add to the project?